PetMarketData: How Smart Pet Retailers Outperform Competitors with Data Insights

> "In the $325 billion global pet care market (Statista 2025), retailers who leverage data insights grow 3x faster than competitors."

Why Data is the Ultimate Game-Changer for Pet Retailers?

The global pet care market has reached unprecedented scale, with Grand View Research (2023) valuing it at 261 billion and projecting 6 billion in 2023 sales, marking the 13th consecutive year of growth. However, this expansion comes with intensifying competition - the number of pet specialty stores grew 8.7% last year (IBISWorld, 2024), while e-commerce now accounts for 38% of all pet product sales (Edge by Ascential, 2024).In this crowded landscape, data intelligence has become the critical differentiator. A 2024 McKinsey study of 1,200 pet retailers revealed that data-driven businesses:

● Grow 2.8x faster than pet industry averages;

● Maintain 23% higher customer retention rates;

● Achieve 18-25% better gross margins through dynamic pricing.

The Data Deficit: Why Pet Retailers Struggle to Access Critical Market Insights

Pet retailers face an uphill battle in obtaining reliable market data, with challenges compounding at every level of the industry. Small independents frequently operate in the dark, forced to make buying decisions based on vendor claims and gut instinct rather than hard sales figures - a dangerous approach when 68% of new pet products fail within 18 months (Packaged Facts 2024). Mid-sized chains encounter different hurdles, often spending thousands annually on multiple disconnected data sources that fail to provide a complete picture, leaving merchants to manually reconcile conflicting reports from distributors, e-commerce platforms, and in-store POS systems. Even enterprise retailers with dedicated analytics teams struggle with the pet industry's unique fragmentation, where critical metrics like Amazon's Best Sellers Rank (BSR) use opaque algorithms that change without warning, and brick-and-mortar sales data lags weeks behind real-time demand shifts.

The problem intensifies when tracking cross-channel trends - while major players like Petco can afford enterprise software to merge online and offline data, most regional operators have no way to identify whether that 30% sales spike for dental chews reflects e-commerce demand, in-store purchases, or temporary social media hype. This data desert forces retailers across the spectrum to gamble on inventory bets that can tie up capital for quarters, with the American Pet Products Association reporting that 43% of specialty retailers cite "inaccurate demand forecasting" as their top profitability challenge. Without access to timely, integrated insights, even the most passionate pet retailers risk losing ground to competitors armed with better information - making comprehensive market intelligence not just valuable, but vital for survival in today's $147 billion U.S. pet market.

Petfairs Revolution: Breaking Barriers in Pet Industry Data Accessibility

Recognizing the pervasive data gap hindering informed decision-making across the pet retail industry, Petfairs has strategically developed a comprehensive solution by aggregating and analyzing multi-channel market intelligence - PetMarketData. Our platform systematically collects and harmonizes online commercial data from dominant e-commerce platforms including Amazon, Temu, AliExpress on Furry Insights, capturing full metrics on pricing, sales, product rankings, and consumer rating. Simultaneously, we compile offline retail intelligence through curated store display images and merchandising layouts from leading brick-and-mortar retailers globally, documenting best practices in product placement, promotional strategies, and category management on Retail Store Visit. By integrating these disparate data streams into a unified analytics ecosystem, Petfairs empowers retailers to overcome information asymmetry—delivering actionable insights that optimize inventory planning, pricing strategies, and trend anticipation. This dual-channel approach equips businesses of all scales to enhance profitability, reduce operational guesswork, and capitalize on emerging market opportunities with precision.

What exactly can PetMarketData provide? Below, we have a step-by-step guide to all functionalities.

Furry Insights: Your Online Market Intelligence Solution

Furry Insights’ database updates 100,000+ online trending pet supplies every month, allowing you to quickly know which pet products can sell the best and boost business growth. The data-driven insights can help you make correct decisions or refine competition strategies to meet market demand in time.

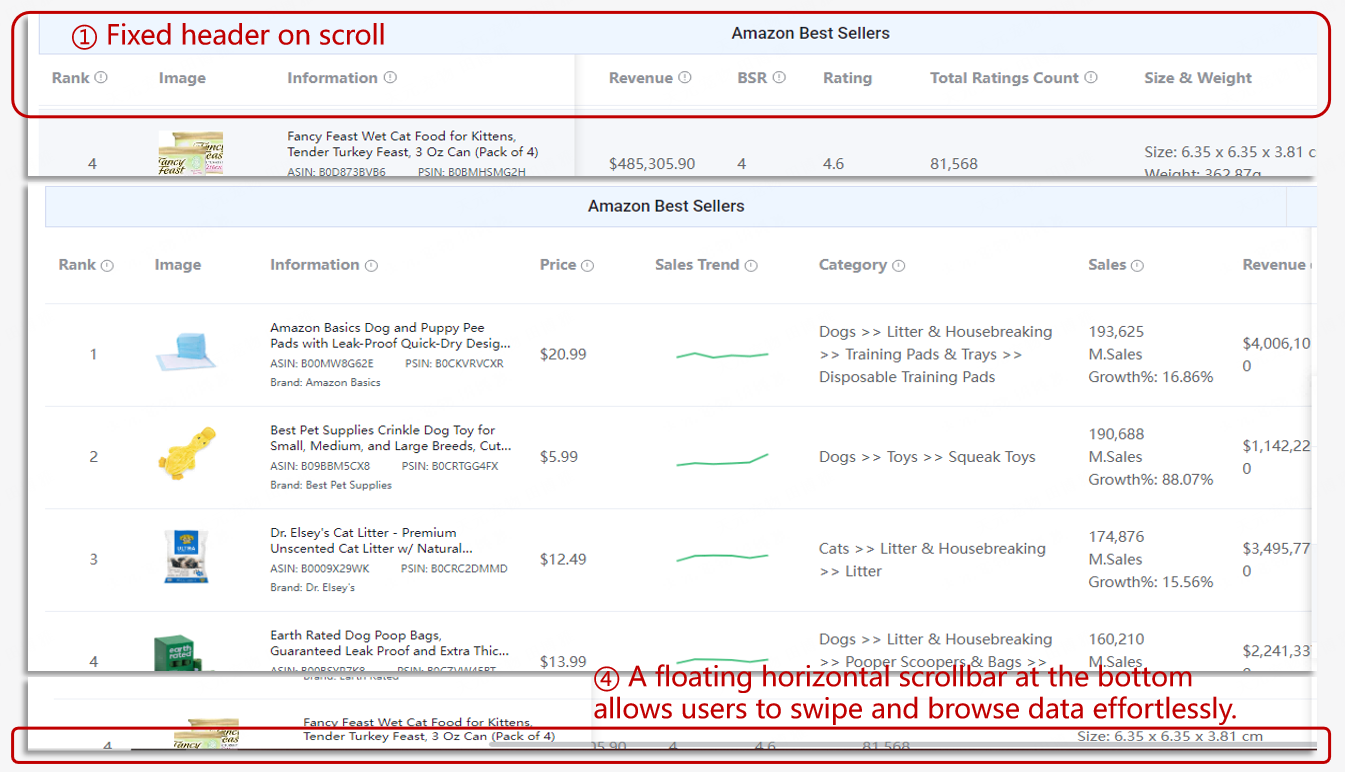

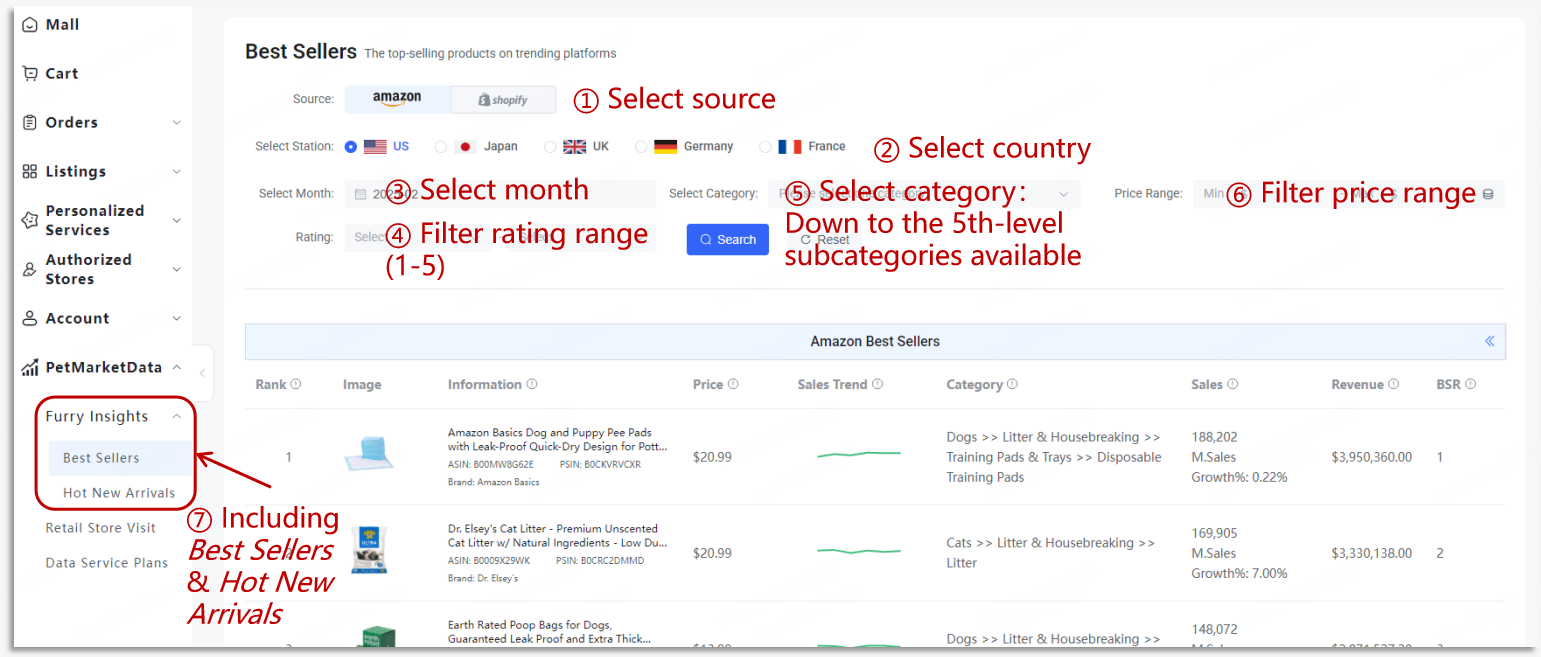

In Furry Insights, the Best Sellers list displays the best sellers for each country station on each platform (i.e., Amazon), including data metrics such as price, sales volume, sales revenue, etc., and platform-exclusive metrics such as BSR on Amazon. Another tool in Furry Insights is Hot New Arrivals, an addition to Best Sellers. Hot New Arrivals shows new items with a basic sales volume and relatively high sales growth rate, reflecting the prevalent tastes of customers. Based on the vast number of popular products, you can develop new products, refine current products, and source hot products confidently!

While accessing the Best Sellers section, you can choose a specific channel and country station, and customize parameters. We currently have 5 country stations for the Amazon channel: the United States, Japan, the United Kingdom, France, and Germany. Once the channel, station, and month are selected, you can click the “Search” button and see the product list. Please note that you need to select at least one channel, country, and month to start the research.Moreover, you can set the parameters to focus on a particular group of products. For example, if you only want to view items under one category or check the products within a certain price or rating range, parameters can be assigned accordingly.

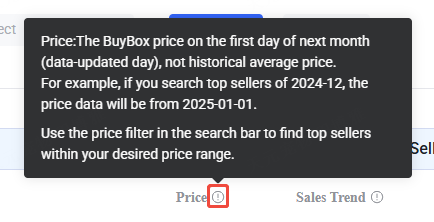

When encountering difficult terms or wishing to understand the calculation rules of certain metrics in Best Sellers and Hot New Arrivals, you can view more information by hovering their mouse over the tooltip icon of each label.

The data formats presented by Best Sellers and Hot New Arrivals are consistent, except that Hot New Arrivals data is based on the conditions: 1. Have basic sales: monthly sales >= 100; 2. Grow rapidly: monthly growth % >= 10%; 3. Recently released: released within 1 year (12 months). Therefore, this instruction will be based on Best Sellers, and the same applies to Hot New Arrivals.

In addition, some tip labels suggest how you explore and get insights from data. Here are the metrics of Best Sellers and Hot New Arrivals:

● Sample Size: The number of top-selling items selected under the specific category.

● Rank: Based on the sales of the selected month.

● ASIN: The best-selling child ASIN under the parent ASIN.

● Price: The BuyBox price on the first day of next month (data-updated day), not historical average price. For example, if you search top sellers of 2024-12, the price data will be from 2025-01-01.

● Sales Trend: Monthly sales of the parent ASIN.

● Category: The category path of the parent ASIN on Amazon.

● Sales: The sales of the parent ASIN in the selected month.

● M. Sales Growth%: The growth rate of the sales in the selected month compared to the previous month.

● Revenue: Revenue = Price * Sales, a predicted amount.

● BSR: The Best Seller Rank in the Amazon top-level pet category ("Pet Supplies"), not in the sub-category.

● Total Ratings count: the total number of reviews of each product.

● Launch Date: The earliest time when the product can be searched. Usually, Amazon can't provide “Date First Available” data.

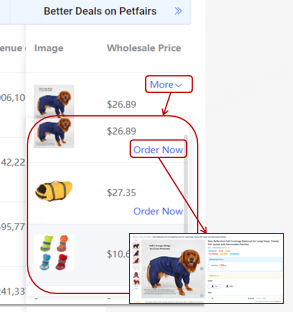

You may also notice the Better Deals on Petfairs list on the right-hand side. You can save time for product selection because Peifairs has similar popular items with BETTER PRICES to source directly! You can simply click Order Now and go to the corresponding product page to view more detailed information.

Retail Store Visit: Your Offline Retail Strategy Goldmine

As a store owner of pet supplies, are you worried about selecting products and arranging your store? The product layout of major supermarkets can give you insights. Retail Store Visit provides 1,000+ high-quality images showcasing product displays from dozens of renowned marketplaces, such as Walmart, PetSmart, Kroger, Menards, and recent exhibitions worldwide. Moreover, this tool also has comprehensive reports analyzing successful pet supply retailers and the latest articles to help store owners catch the trends.

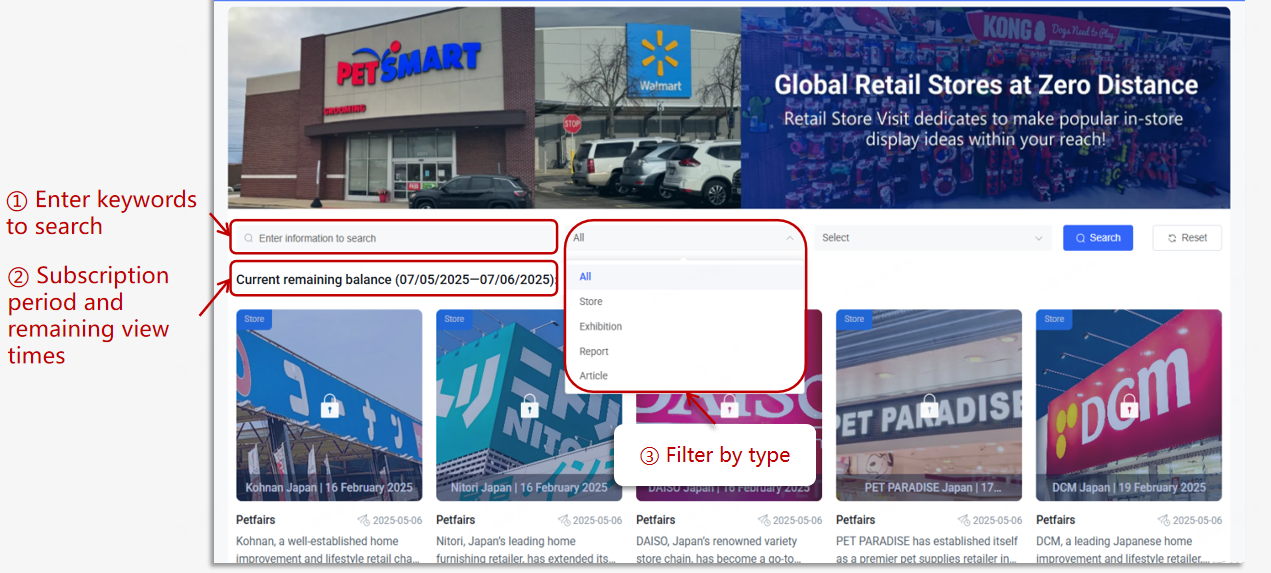

The main page of Retail Store Visit displays all types of documents, including exhibitions, stores, reports, and articles, in chronological order from the most recent to the oldest by default. You can search documents by keywords and type.

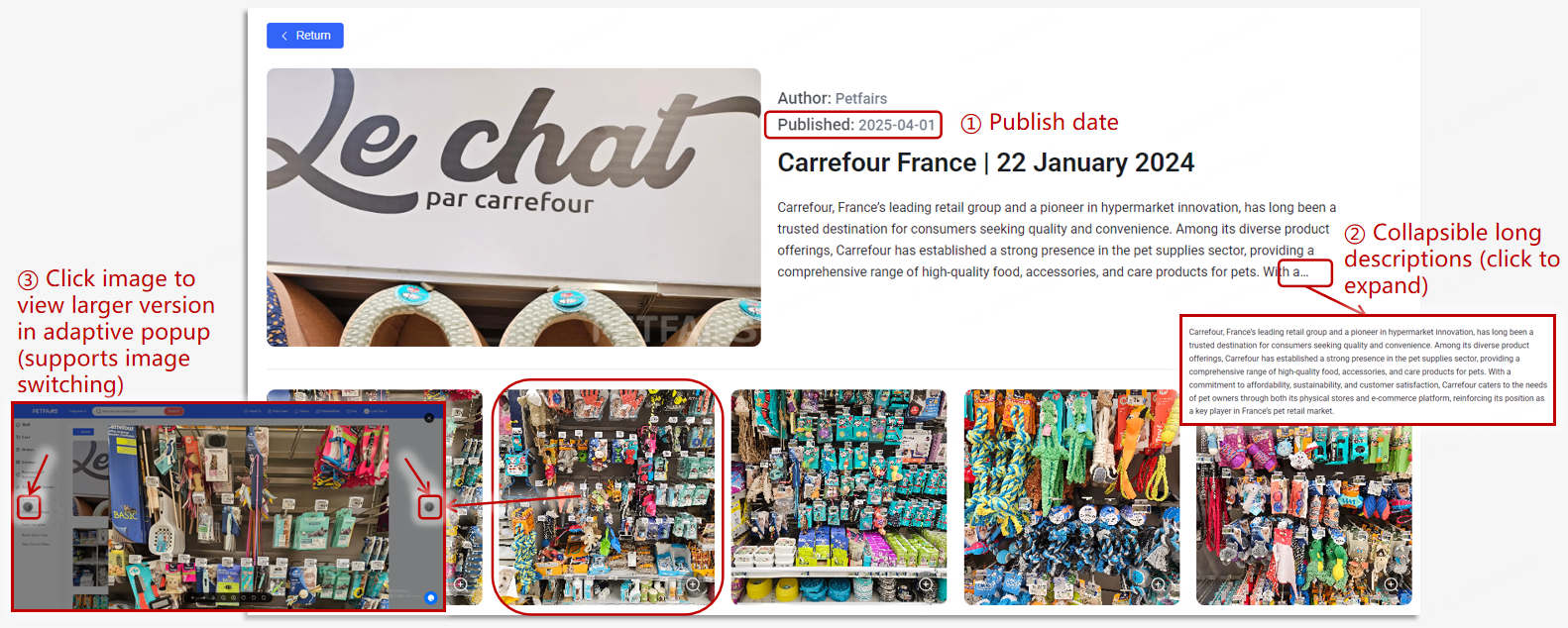

By clicking on collections and consuming 1 view time for each collection, you can unlock corresponding content. For the Exhibition and Store collections, you can access a variety of detailed images showcasing pet product displays in large-scale exhibitions and retail stores. These images include the description of the exhibition/store, layout of each display corner, the types of products in each corner, product pricing, and ongoing promotional activities. Whether a retailer plans to open a new store or revitalize an existing one, this tool will help understand what products are displayed, how they are priced, which kind of promotions are adopted, and why these strategies drive sales. Therefore, these image collections will be highly valuable and insightful for owners of physical retail stores.

Retail Store Visit also provides professional reports based on the images of exhibitions and stores. According to their expertise in the pet industry, professional analysts evaluate the pet products displayed in exhibitions and stores to identify current trends and predict future prevalent trends in offline pet products. In addition, articles conclude the latest industry news concisely and professionally.

In Retail Store Visit, you will gain access to the visual strategies and merchandising techniques employed by the most successful pet supply retailers. Never miss this chance to have a look at the offline giants’ layout and plan your arrangement!

How PetMarketData Boosts Profitability for Your Pet Retail Business

Overall, PetMarketData contains enormous and powerful data and insights. It’s the ideal shortcut for a pet business in its early stages, such as:

● Accelerated Product Selection: Implement data-driven methodologies to streamline product vetting and decision-making, reducing time-to-market while maintaining quality standards. Leverage predictive analytics to identify high-potential products, ensuring alignment with market demand and consumer trends.

● Inventory Efficiency & Risk Mitigation: Proactively prevent overstock situations through demand tracking and just-in-time inventory strategies. Optimize stock turnover rates to minimize holding costs, improve cash flow, and reduce waste from obsolete inventory.

● Competitor Benchmarking & Gap Analysis: Conduct granular competitor research to identify pricing, feature, and positioning differentiators. Utilize competitive intelligence tools to uncover market whitespace and refine value propositions.

● Product Layout Rationalization: Spot how top physical retailers display in-store pet products. Boost sales performance by referring to validated product placement configurations.

Conclusion: Empowering Pet Retailers with Data-Driven Success

In today’s hyper-competitive pet retail landscape, data intelligence is no longer optional—it’s the key to survival and growth. With the global pet care market surpassing $325 billion and e-commerce capturing nearly 40% of sales, retailers who fail to leverage actionable insights risk falling behind competitors growing 3x faster with data-driven strategies.

PetMarketData by Petfairs bridges the critical gap in pet industry intelligence, offering a comprehensive, dual-channel solution that combines real-time e-commerce analytics (Furry Insights) with offline retail merchandising intelligence (Retail Store Visit). By unifying fragmented data streams into a single, actionable platform, PetMarketData empowers retailers to identify best-selling products before competitors, optimize pricing and promotions for maximum profitability, reduce inventory waste with accurate demand forecasting, and benchmark against industry leaders to uncover hidden opportunities.

Whether you're a small independent retailer or a growing chain, PetMarketData transforms guesswork into strategic advantage, ensuring you stay ahead in a market where 43% of retailers cite inaccurate forecasting as their biggest challenge.

The future of pet retail belongs to data-driven decision-makers. With PetMarketData, you’re not just keeping up—you’re leading the pack. Now SIGN UP to get a 7-day FREE TRIAL and begin your smart sourcing journey! Petfairs warmly welcome you to join PetMarketData plans and genuinely wish you great sales success!